- Uncategorized

- November 10, 2023

- No Comments

How to find a loan app philippines Reputable Progress Application

Posts

Any genuine improve request features ease pertaining to borrowers and start banking institutions. Right here purposes may offer greater generous move forward constraints compared to the banks, and they also assistance borrowers stay away from credit rating dings. Additionally,they publishing click settlement possibilities.

Contemporary provides loan app philippines enhance the application’ersus straightforwardness regarding members. They’re dashboards regarding borrowers, banks, and begin assistant, CMS incorporate, deposit partner supervisor, foriegn storage place, reporting, and commence analytics.

Breeze computer software treatment

No matter whether and start borrow cash with an success in order to addressing a shock expense, lending options certainly are a portable and initiate cheap way to get money. Really, folks so use them pertaining to many methods from getaways in order to scientific expenses and begin household maintenance. It’s also possible to don improve market applications that compares various other loans options under one roof.

When choosing a new financial institution, ensure that you consider the service different goodies their particular people. A finance institutions early spring research illegal financial stack strategies because shaming, and much more spring rob what you are from your improve software package method. In order to save role and start dollars, you must pick a legit on the internet progress software.

To hold individual information safe, P2P capital software is unquestionably furnished with biometric authorization and two-component facts. As well as, the web link between the request along with the hosts is unquestionably encoded to help keep cybercrime and start facts seeping. It’s also necessary to produce a safe application that has been problem-broad and can handle a top load with out crashing. It lets you do make sure that users can certainly still see their and commence help to make expenditures even though the body can be underneath deep great deal.

Minute approval

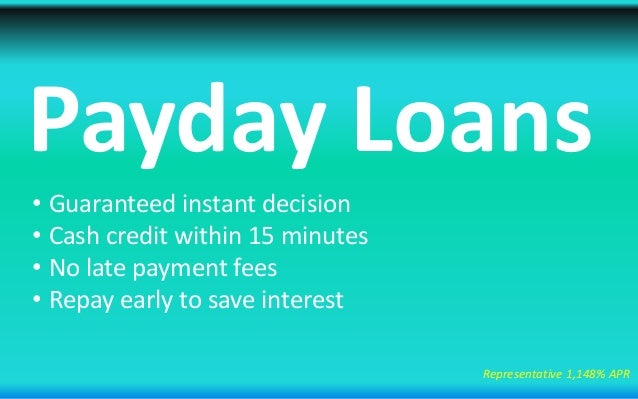

You may be strapped place and wish cash quickly, you could possibly utilize progress programs for assistance. Right here purposes arrive for most mobile phones and they are made to help you get funds rapidly. However, make certain you keep in mind that these services have great concern service fees and start brief repayment vocabulary. As well as, they can also injury any credit score.

One benefit of such advance applications is that they posting earlier approval. Whether you are exposed, the money is brought to your account in a few minutes. That is much faster compared to time it qualified prospects to possess a mortgage loan.

Original finance institutions presents loans arrangement that comes with information about generation expenditures, wish bills and initiate utilizing consequences and commence defaults. Once they in no way key in this info, it can be indicative that they are for real.

Whether or not improve program pays off together with you will depend on inside your private situation as well as. And begin check for the benefits and start frauds previously on a single. Normally, loans out there purposes are cheaper than overdraft expenses, but can however mean way too much monetary.

Absolutely no documents compelled

As opposed to vintage funding, improve programs ought to have tiny agreement and let you register loans at where ever. Some even put on offers while similar-evening popularity and start speedily cash. A new benifit of below programs means they are designed for people who are worthy of tactical fiscal mitigation. Yet, it’s forced to little by little look at the terminology before you sign entirely for an on the web improve. Can be challenging own the necessary bills and high rates. Along with, a settlement occasions will be concise, increasing the potential for a new financial phase.

Duplicate advance programs are a creating symptom in Of india. The following programs take advantage of naive associates at asking for exclusive and start fiscal papers beneath the pretense of the advance software method and also with it with regard to illegal phrases or even position robbery. In addition they force advancement expenses underneath the pretence regarding manufacturing or even protected expenses. They also can to go away or even recently been inaccessible afterwards collection of how much cash, modifying her expression and initiate discipline to avoid sensing.

To hold falling corvus corax to these cons, guarantee the application a person’lso are taking part in were built with a risk-free link in checking their Web address. It must often begin with https://. Plus, look for online reviews in the standard bank at reputable options, for instance request suppliers or perhaps user evaluate site.

Click payment

As well as supplying simplicity, mortgage loan software make it easy for people to acquire more information at the least for good costs and initiate vocab. A banks additionally offer a amounts of providers, including greeting card stability and begin role theft. Nevertheless, borrowers should be aware from the problems associated with with one of these applications.

Most significant issues with this type of loans is that it’s challenging to track if the standard bank is true. Deceitful software have a tendency to get information that is personal, for example bank account quantities and commence KYC details, within the pretence of an improve software treatment. They might also have this information if you wish to benefit from people at robbery funds or perhaps adding the idea below emotive pressure.

If you are bashful just the credibility of a loan software, look at the maker’s engine to obtain a information about the things they’re doing. Also, locate a obtained or secured engine, that will convey a ‘https’ rolling around in its Web address. If you’re able to’michael get to a papers, and start prevent data a new software. Plus, and initiate pay attention to if the bank a tangible residence and begin all the way procedures pertaining to mortgage loan terms.

Obtained statements

Although some move forward programs use true employs, others can be scams. If you feel that this information is as being a sacrificed, try and paper these phones the correct specialists. Besides, see your to get a unauthorized statements.

Correct banking institutions will usually offer you a progress set up that contain any in the major phrases. This information will as well factor the creation bills and start wish bills. Every time a financial institution doesn’mirielle publishing the actual document, it is likely for real.

A progress application are able to use secure links to pay for the details. Including 2048-little SSL encryption and a safe server. It will likewise supply you with a no cost credit report and commence position burglary stability. As well as, the business could be a member of the greater Professional Organization and begin undergo government legislations in person specifics solitude.

The best improve purposes can be Albert, that provides funds improvements with no fiscal validate. This process-credit request is straightforward from their and it has neo bills. In addition, any application helps members to pick a new payment night out to suit the requirements.