- Uncategorized

- October 11, 2024

- No Comments

9 Best Virtual and Outsourced Accounting Services in 2024

You can also get support on creating and receiving invoices to your customers and also for paying your bills through Pilot. It might take you upto two weeks to get started with Bookkeeper360 but once you do, you will be appointed a dedicated accountant. Small businesses are generally short on resources and there are often few people handling everything. This not only increases the time needed to do something but also increases the chances of errors. A business owner may be accustomed to having direct oversight of daily financial operations and may find how to determine the cost per unit chron com it challenging to cede control. We harness the power of AI and machine learning to ensure daily bookkeeping tasks adhere to GAAP standards, delivering accurate results promptly.

One of the best advantages of working with an outsourced accounting team is that you’ll get access to the most up-to-date accounting software. Several businesses are outsourcing accounting services to fill their company’s needs with the best knowledge and qualifications. Outsourced accounting refers to all the accounting services from what are t accounts definition and example an external service provider hired by a business. The same goes for payment terms, since some charge by the hour and others by the month. Therefore, your decision will require some budgeting on your end to see what you can afford—whether it be an accounting partner or an alternative. The best virtual accounting software integrates with the best payroll software and brings them together with your accounting.

Virtual CFO Services

- Outsourced accounting refers to all the accounting services from an external service provider hired by a business.

- An early and open discussion about this can keep you from being hit with unexpected costs down the line.

- After assigning a weighted score to each category, we formulated rankings for each company.

- Whether you are a sole proprietor or a business, Bench has a tie-up with Taxfyle and provides tax advisory as well as filing services.

- We have also included a section that will help you choose the best virtual bookkeeping service.

In essence, these services empower small businesses by offering comprehensive financial solutions, allowing them to thrive in competitive markets while maintaining financial stability. Reputable service providers employ robust security measures to protect your financial information. With real-time updates and reporting, you gain a comprehensive overview of your financial status. In essence, outsource bookkeeping services empowers your business with expertise, efficiency, and cost savings, allowing you to navigate the financial landscape with confidence.

It’s also ideal for brand-new businesses because FinancePal can help with entity formation. Many accountants offer bookkeeping as part of their accounting services or are willing to get you caught up before tax season. But the catch is that a CPA will generally charge more per hour than a bookkeeper would. They’ll typically charge their hourly rate, which is higher than a bookkeeper’s, because of the hard work in getting accredited. For example, when you sign up with Bench, you’re paired with a team of professional bookkeepers who gather your data and turn it into tax-ready financial statements each month. Then, our platform lets you track your finances, download financial statements for your accountant, and message your bookkeeping team.

Understanding the Components of Bookkeeping Outsourcing Costs

Having professionals do your books will save you time and give you peace of mind. And the benefit of working with an online service means that you can store your data securely in the cloud, and access your financial info from anywhere, any time. Outsourced bookkeeping streamlines the financial management process and is much more efficient than traditional in-house bookkeeping. Doing the bookkeeping yourself is a time-consuming task, time that you most likely don’t have as a business owner. When you outsource bookkeeping, you will save valuable time that can be put back into improving your business in other ways.

Which Virtual Bookkeeping Service Should I Pick?

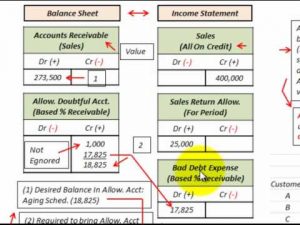

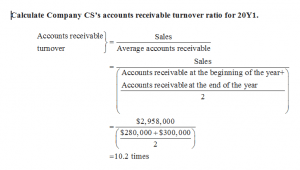

Professional bookkeepers generate detailed financial reports like income statements and balance sheets. These reports offer valuable insights into a company’s financial health, assisting in informed and strategic decision-making processes. The cost of bookkeeping services can vary depending on the size of your business capital and maintenance and the features you need.

This could be anything from a partial refund for a late delivery, to termination of the contract in more extreme cases. Once you’ve established what you want to outsource, the next next step is to identify who you’re going to outsource it to. As well as helping you comply with all relevant laws, this ensures that you are fully prepared if your company gets audited. So first you need to identify the kind of solution that your business needs and then pick a solution that best fits it. If you have multiple projects that you want to track individually, you can track the revenue and expenses for multiple projects individually through their project accounting feature.

Outsourcing payroll services ensures accurate and timely salary processing, tax withholdings, and compliance with evolving payroll regulations. This strategic move helps businesses sidestep costly errors and concentrate on their core operations. There are a few decisions to make when outsourcing bookkeeping—most notably, local vs. virtual and freelancer vs. firm. All options have pros and cons that depend on what you’re looking for from your accounting service. Experienced bookkeepers are often better at finding overdue clients and cuts your company could make to increase overall profit.

You can access all your accounting records round the clock and you can also get help from the team of accountants if you need them at any point. If you are just starting and need someone to set up your payroll, Bookkeeper360 will help you. You can also integrate with payroll management software like Gusto and ADP so that your payroll and bookkeeping can be accessed from one place. Bench is a good solution if you want someone else to do the bookkeeping for you and if you are a small business or a freelancer. When you sign up for their service, you will be assigned a team of three bookkeepers including a senior bookkeeper. If you are looking for a simplified online bookkeeping solution, Merritt Bookkeeping is just the solution that will come to your rescue.