- Uncategorized

- June 22, 2021

- No Comments

Depreciation & Interest Tax Shields and Capital Budgeting

Understanding the concept of a tax shield can have a significant impact on your financial decision-making. By taking advantage of legitimate deductions, tax credits, and depreciation allowances, businesses and individuals can minimize their tax liability and retain more of their hard-earned income. It’s important to consult with a tax professional or financial advisor to understand the specific tax provisions applicable to your situation and optimize the use of tax shields effectively.

Tax Shields for Depreciation

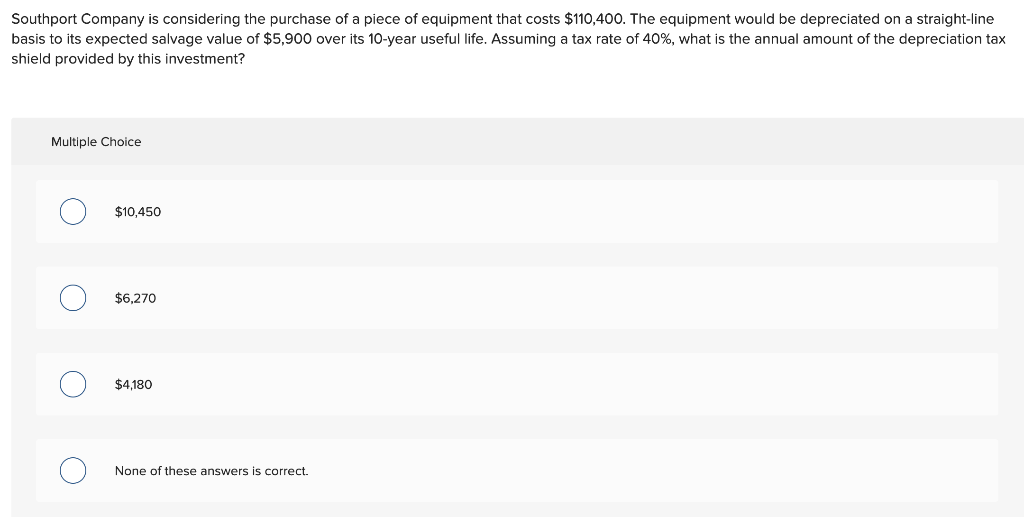

Let us take the example of another company, PQR Ltd., which is planning to purchase equipment worth $30,000 payable in 3 equal yearly installments, and the interest is chargeable at 10%. The company can also acquire the equipment on lease rental basis for $15,000 per annum, payable at the end of each year for three years. The original cost of the equipment would be depreciated at 33.3% on the straight-line method. Although tax shield can be claimed for a charitable contribution, medical expenditure, etc., it is primarily used for interest and depreciation expenses in a company.

Formula for Calculating a Tax Shield

The Interest Payments are typically tax-deductible, which lowers the Company’s tax bill. Private Equity Funds typically use large amounts of Debt to fund acquisitions. The Debt used in the purchase creates Interest Expense that reduces the acquired Company’s Tax bill. Below we have also laid out the Depreciation Tax Shield calculations using the Sum of Years Digits approach. Below are the Depreciation Tax Shield calculations using the Straight-Line approach.

Navigating Crypto Frontiers: Understanding Market Capitalization as the North Star

Assuming a straight-line depreciation method, the business can deduct $5,000 ($50,000 divided by 10) from its taxable income each year for ten years as a depreciation expense. Meanwhile, the company maintains its own depreciation calculations for financial statement reporting, which are more likely to use the straight-line method of depreciation. This alternative treatment allows for the use of simpler depreciation methods for the preparation of financial statements, which can contribute to a faster closing process. For depreciation, an accelerated depreciation method will also allocate more tax shield in earlier periods, and less in later periods. However, it is important to consider the effect of temporary differences between depreciation and capital cost allowance for tax purposes. Therefore, while the company paid $100,000 for the machinery, the actual after-tax cost is effectively lowered to $73,000 ($100,000 – $27,000) thanks to the depreciation tax shield.

How are Tax Shields Strategically Used?

The use of a depreciation tax shield is most applicable in asset-intensive industries, where there are large amounts of fixed assets that can be depreciated. Conversely, a services business may have few (if any) fixed assets, and so will not have a material amount of depreciation to employ as a tax shield. The intuition here is that the company has an $800,000 reduction in taxable income since the interest expense is deductible. An alternative approach called adjusted present value (APV) discounts interest tax shield separately. Even though the APV method is a bit complex, it is more flexible because it allows us to factor-in the risk inherent in admissibility of interest tax shield.

- ABC Ltd. is considering a proposal to acquire a machine costing $ 1,10,000 payable $ 10,000 down and balance payable in 10 equal installments at the end of each year inclusive of interest chargeable at 15 %.

- The concept is significant while making financial decisions in any capital-intensive business.

- As you can see from the above calculation, the Depreciation Tax Savings as the expense increases.

The concept is significant while making financial decisions in any capital-intensive business. Depreciation tax shield is the reduction in tax liability that results from admissibility of depreciation expense as a deduction under tax laws. A tax shield represents a reduction in income taxes which occurs when tax laws allow an expense such as depreciation or interest a freelancer’s guide to invoicing and getting paid as a deduction from taxable income. Depreciation allows businesses to spread out the cost of an asset over its useful life. For tax purposes, depreciation is considered a business expense, and businesses are allowed to deduct it when calculating their taxable income. As a result, it reduces the overall taxable income, thus lowering the amount of tax payable.

Let us consider an example of a company XYZ Ltd, which is in the business of manufacturing synthetic rubber. As per the recent income statement of XYZ Ltd for the financial year ended on March 31, 2018, the following information is available. For Scenario A, the depreciation expense is set to be zero, whereas the annual depreciation is assumed to be $2 million under Scenario B.

Since depreciation is a non-cash expense and tax is a cash expense there is a real-time value of money saving. The impact of adding/removing a tax shield is significant enough that companies will take it into account when considering their optimal capital structure, which is their mix of debt and equity funding. Since the interest expense on debt is tax-deductible (while dividend payments on equity shares are not) it makes debt funding that much cheaper.