- Uncategorized

- October 6, 2024

- No Comments

Do i need to Lay All of My Added bonus inside my 401k to End Taxation? The newest Colony

The reduced the brand new wagering conditions, the simpler it is in order to meet him or her and money out your payouts. Check always the new conditions and terms of the invited bonus to make sure you’re also getting the finest give. These types of bonuses offer people a set quantity of spins to the certain on line slots or a group of games, allowing them to gain benefit from the adventure of one’s reels instead dipping within their own money. Particular casinos generously give 100 percent free spins included in its acceptance added bonus plan otherwise because the a standalone venture for current players. The terms of reload incentives may differ, like the lowest put expected plus the match fee offered.

Bonus Depreciation: The goals as well as how It works

This is the greatest option for those individuals choosing the large quality casino incentives. With the amount of big gambling establishment incentives offered, it may be challenging to select the right choice for you. In this section, we’ll offer tricks for selecting the best local casino bonuses according to your playing tastes, comparing added bonus small print, and you may evaluating the online local casino’s profile. Like with other types of bonuses, always check the brand new conditions and terms of your reload bonus so you can always’re having the best deal and can meet up with the wagering requirements. You’ll receive a level better value once you guide five or a lot more consecutive award night, due to Marriott’s fifth-night-totally free cheer. In turn, you can even get Marriott Bonvoy issues with this particular incentive to greatest up your be the cause of a five-night redemption.

When you pick individual property for your business, for example an automobile or computer system, one to lasts for one or more year, you happen to be needed to subtract the cost a tiny at a happy-gambler.com why not find out more time more ten years. This action is named “depreciation.” According to the property involved, it takes between 3 to help you 39 many years to completely depreciate the cost of business possessions. The brand new Operate hired the modern Modified Expidited Prices Recuperation Program (MACRS) healing periods of 39 and you will 27.five years for nonresidential and residential rental assets, respectively.

It may be difficult to have a redemption your’d desire to build, that have offered award place on top of that, but you don’t have very sufficient issues or miles to make the reservation. Of course, you can hold back until you are doing, but when you’re trying to publication a corporate- otherwise first-classification award ticket, prize room is disappear quickly. We really worth Realm of Hyatt points from the step one.5 dollars apiece, although it’s tend to it is possible to for more really worth than just you to.

Cost segregation is specially important to real estate trading or companies that may maybe not claim bonus decline to your QIP by the election outside of the interest deduction restriction. These types of agencies get desire the brand new tax enjoy the reclassification away from individual property to reduced taxation recuperation periods ultimately causing accelerated decline deductions. To possess depreciation objectives, home is experienced listed in provider when the advantage is prepared and you will designed for include in its intended setting. Taxpayers often and get depreciable possessions such as devices and you will gizmos prior to they begin their meant earnings-generating activity. In these things, basically decline write-offs might not be claimed for the machines and you may products before taxpayer’s company starts as well as the depreciating advantage is utilized in that interest.

Thrillzz Personal Sportsbook Promo Password: Purchase $10+ and possess $31 inside the Sweeps Gold coins!

If the incentive decline deduction produces an online doing work losings to possess the entire year, the company can hold submit the web operating losings to offset coming income. Added bonus decline are recommended—you don’t have to take it otherwise want to. But if you need the largest decline deduction your is, you should take advantage of this option whenever you can.

The newest introduction out of utilized assets has been a serious, and you can advantageous, move from prior extra depreciation laws. Enterprises can take a hundred% extra decline on the accredited possessions each other obtained and you may placed in service after Sept. 27, 2017, and you can prior to Jan. 1, 2023. The purchase time to have property received pursuant to a created joining deal ‘s the go out of these bargain that will have lengthened added bonus episodes. Full added bonus depreciation are phased down by 20% yearly to own possessions listed in service once Dec. 29, 2022, and you can ahead of Jan. step one, 2027. The new Wyden-Smith agreement “manage restore about three biggest team terms (100% extra depreciation, R&D expensing for residential Roentgen&D simply, and you will a loose restriction to the company focus deductions) because of 2025,” York told you.

Such tours try 45 minutes much time and provide a complete-human body indoor cycling work-out. Bilt also provides around $2,five hundred to one driver participating in an october Rent Go out Trip class to cover thirty day period away from lease. You can earn issues once you discover a high-three respond to, once you precisely rank you to answer and when the new celebrity invitees selections a comparable respond to since you. All the information to your Hilton Amex Searching for cards has been obtained on their own by Things Man. This is what you have to know about the Oct Bilt Lease Date promotions.

Heavens Canada Aeroplan is now giving 50%, 60% otherwise 85% bonus items, according to the number of things you order. You ought to pick no less than 4,000 points to have the minimum fifty% bonus, which provides you a rate of just one.7 dollars for each area. If you buy twenty five,100 or maybe more, you’ll receive maximum 85% extra, and therefore will bring the price right down to step 1.4 dollars per — a bit below TPG’s September 2024 valuation of 1.5 cents. When you are extra decline and you will Section 179 try one another immediate expenses write-offs, incentive depreciation lets taxpayers so you can subtract a portion from a secured item’s prices initial. However, Section 179 lets taxpayers to deduct a set money number. Extra depreciation — also known as the excess earliest-12 months decline deduction or even the 168(k) allotment — accelerates by allowing organizations to write away from a lot of a qualified asset’s prices in the first season it was bought.

The newest one hundred% added bonus perform reduce the rate to one.75 dollars for each and every mile, a lot more more than TPG’s Sep 2024 valuation of just one.35 dollars for each and every to possess Joined miles. Hence, if you don’t features a certain redemption at heart and would like to top off your bank account balance, i won’t strongly recommend to purchase a lot more kilometers. JetBlue TrueBlue has to offer to a great 125% bonus once you get at least 3,one hundred thousand things. Which give are allegedly targeted, nevertheless appears extremely TrueBlue people try watching a similar 125% incentive. So it incentive provides the price per part right down to a flat price of just one.33 cents for each and every — almost close to level that have TPG’s September valuation of just one.step 3 cents for every.

Typically, minimal deposit for a welcome added bonus ranges of $5 in order to $20, because the matches percentage may vary out of 100% so you can two hundred%. Information these details enables you to discover the most suitable invited bonus to your requirements, avoiding undesired shocks. If you’ve already earned the brand new bonuses to your better Marriott borrowing cards, to find things using this write off was appealing, but merely under the best issues.

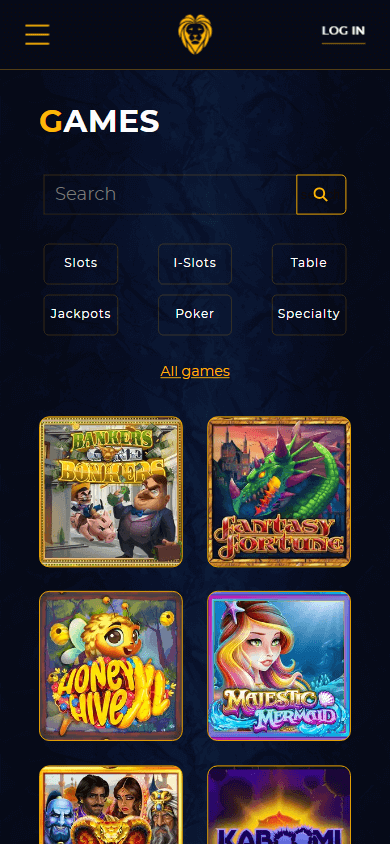

You could investigate checklist or include your filters to find the best gambling enterprise for your requirements. If you are a casino invited added bonus becomes your become on your own trip, the best web based casinos also provide other incentive offers to continue you heading. If you’lso are trying to find a totally free revolves bonus for that something additional, otherwise prefer to get a great cashback to your a share of the losses, you’ll find something for everyone professionals. What’s far more, you’ll always get a reasonable bonus from your ideal websites.