- Uncategorized

- February 28, 2024

- No Comments

Undivided Profit: What It is, How It Works, Example

Companies can achieve this by reinvesting profits back into the business to fund expansion projects, research and development, or acquisitions. In scenarios where a company pays out dividends, the net income may not align with retained earnings. Dividend payments reduce the amount of profits retained by the company, affecting the growth potential and available funds for reinvestment. Retained Earnings are a vital financial metric that sheds light on a company’s financial strength and growth potential. Investors and business owners alike can use this metric to make informed decisions and understand a company’s financial performance over time.

What Are Retained Earnings?

This reduction happens because dividends are considered a distribution of profits that no longer remain with the company. Another important aspect of undistributed profit is that it can be used to increase the company’s equity base, which can improve its financial stability and creditworthiness. By retaining a portion of its profits as undistributed profit, a company can build up its equity reserves and reduce its reliance on external sources of funding. Retained earnings are the portion of a company’s cumulative profit that is held or retained and saved for future use. Retained earnings could be used for funding an expansion or paying dividends to shareholders https://www.bookstime.com/articles/tax-shield at a later date. Retained earnings are related to net (as opposed to gross) income because they are the net income amount saved by a company over time.

Example of Accumulated Income

Undistributed profit, or retained earnings, is a critical component of a company’s financial strategy. It represents the portion of a company’s net income that is not distributed to shareholders as dividends but rather reinvested in the business. This financial resource enables companies to fund growth, reduce debt, and withstand economic downturns.

- Undistributed profit, on the other hand, refers to the portion of a company’s profits that have not been distributed to shareholders as dividends.

- Accumulated income, commonly referred to as retained earnings, includes the portion of net income that is retained by a corporation over time, rather than being distributed as dividends.

- External factors such as economic fluctuations can significantly impact the accuracy of these calculations.

- As the formula suggests, retained earnings are dependent on the corresponding figure of the previous term.

- It represents the cumulative earnings of the company that have not been distributed to shareholders, and can be used to support a wide range of financial activities.

Limitations of Retained Earnings

For instance, in 2018, Apple used its substantial retained earnings to acquire Shazam, a popular music recognition app. By maintaining clear and concise records of retained earnings, companies can demonstrate their financial health and stability to investors and creditors. For example, technology firms may reinvest more in research and development, resulting in lower retained earnings despite strong growth prospects.

For example, during the period from September 2016 through September 2020, Apple Inc.’s (AAPL) stock price rose from around $28 to around $112 per share. During the same period, the total earnings per share (EPS) was $13.61, while the total dividend paid out by the company was $3.38 per share. As an investor, one would like to know much more—such as the returns that the retained earnings have generated and if they were better than any alternative investments. Additionally, investors may prefer to see larger dividends rather than significant annual increases to retained earnings. Companies often utilize retained earnings as a strategic financial tool for business expansion.

Net Income Explained

- Undivided profits refer to gains from current and past years that have not been transferred to a surplus account or distributed as dividends to shareholders.

- The company might also issue a “Statement of Retained Earnings” to show the changes in retained earnings over the course of the year, including the net income earned and dividends paid.

- When a company earns a lot in a year and makes huge profits, a portion of the profits is set aside and reinvested in the business.

- It’s important for investors and analysts to scrutinize how a company uses its undistributed profits, as it can provide insights into the company’s growth prospects and financial stability.

- Therefore, a company with a large retained earnings balance may be well-positioned to purchase new assets in the future or offer increased dividend payments to its shareholders.

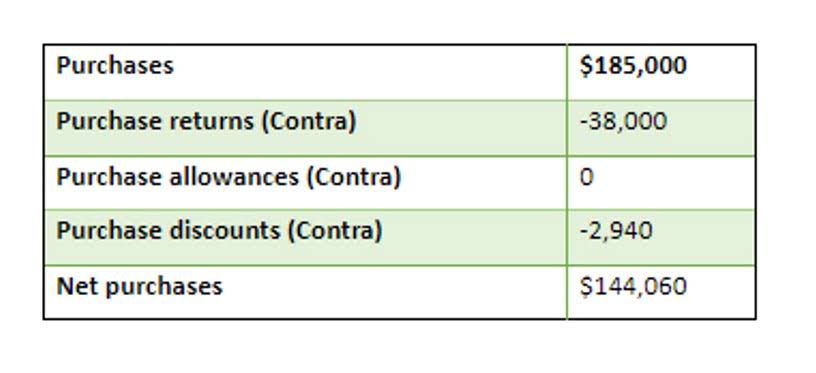

- Retained earnings are calculated through taking the beginning-period retained earnings, adding to the net income (or loss), and subtracting dividend payouts.

- A report of the movements in retained earnings is presented along with other comprehensive income and changes in share capital in the statement of changes in equity.

A secret reserve is created by underestimating the value of assets or overestimating liabilities on the company’s financial statements for internal purposes. When a company earns a lot in a year and makes huge profits, a portion of the profits is set aside and reinvested in the business. In the evolving financial landscape, the management of retained earnings is becoming increasingly complex. These may include net income, cash flow, undistributed profits that have accumulated in the company over time are called and overall profitability to gain a holistic view of the company’s financial performance.

TCP CPA Exam: Calculate Gain or Loss on Sale to Unrelated Third Party from Related Party

When the dust settles at the end of the year, a business can generally do one of two things with excess cash. It can either plow it back into the business to improve or grow organically or it can return capital to its rightful owners, whether they are equity shareholders or creditors. Accumulated income, commonly referred to as retained earnings, includes the portion of net income that is retained by a corporation over time, rather than being distributed as dividends. Any accumulated income is typically used by the corporation to reinvest in its principal business or to pay down its debt. Yes, having high retained earnings is considered a positive sign for a company’s financial performance.

Net Income vs Retained Earnings: Key Differences Demystified

One key attribute of surplus reserve is that it is a voluntary action taken by the company’s management. Unlike dividends, which are typically paid out to shareholders on a regular basis, surplus reserve is a strategic decision made by the company to retain a portion of its profits for future use. In conclusion, surplus reserve and undistributed profit are both important financial resources that companies use to support their operations and growth initiatives. While they have some similarities, such as being portions of a company’s profits that are not distributed to shareholders, they have distinct attributes that make them unique and valuable in their own right.

By setting aside a portion of its profits as surplus reserve, a company can better weather economic downturns or unexpected expenses. Surplus reserve can also be used to fund growth initiatives, such as acquiring new assets or expanding into new markets. Breaking down the formula components, beginning retained earnings represent the previous year’s undistributed profits. Net income reflects the current year’s earnings after expenses, while dividends are the portion of profits https://x.com/BooksTimeInc distributed to shareholders. Net income represents the profit a company has after subtracting all expenses from its total revenue.